This is an automated translation.

Last week, SwissHoldings took an in-depth look at the EU’s new rules on sustainability reporting at an internal online conference organised by the association. The focus was on the Corporate Sustainability Reporting Directive (CSRD) and the associated European Sustainability Reporting Standards (ESRS). Together with representatives of European companies (A1 Austria and Austrian Post), speakers from the SwissHoldings membership (in particular Nestlé) and academics, the workshop analysed the impact of these new regulations and the practical challenges of CSRD implementation projects. They discussed what companies can do to adapt their reporting systems and processes as well as data management to the upcoming new requirements.

The SwissHoldings workshop focussed on the Corporate Sustainability Reporting Directive (CSRD), which was adopted by the EU in November 2022 (see also the agenda below). All speakers at this online conference shared the view that the directive would profoundly change the scope and nature of companies’ existing sustainability reporting. A core element of the implementation of the new reporting obligations is that reporting must be based on the principle of so-called “double materiality”. This is because in recent years, materiality has been viewed from two perspectives in the context of sustainability: “impact materiality” and “financial materiality”. The former view focuses on sustainability issues that are materially influenced by the company’s business activities – while the latter category identifies the issues that have a material impact on business activities.

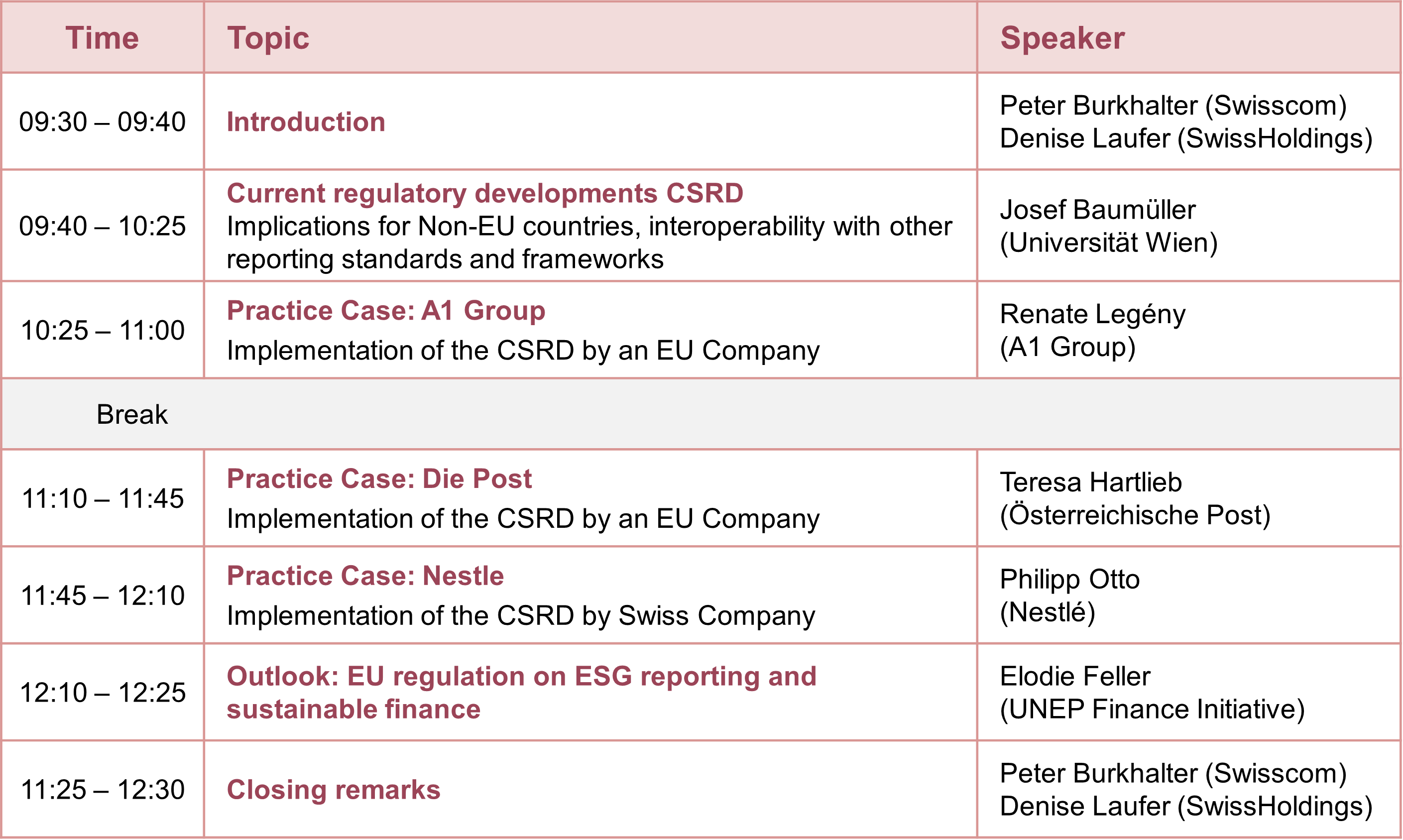

Figure: The agenda of the online conference

The fact that forward-looking and qualitative information must increasingly be disclosed was also cited as a key driver for the increasing complexity of reporting. For example, information on the business model and corporate governance, a detailed timetable for their sustainability initiatives, as well as quantitatively collected key performance indicators (“KPIs”) on the impacts and risks of their corporate activities across the entire value chain must be presented. Reporting must be carried out in accordance with the European Sustainability Reporting Standards (ESRS) developed by the EU. A separate standard is to be developed for companies from third countries that are required to report. Other international regulations can be categorised as equivalent by the EU. However, the provisions for this are still pending.

Companies must now report on 1,000 data points

Many SwissHoldings member companies are directly covered by the CSRD via their subsidiaries in EU member states. Most of them will be required to report on the new requirements for the first time for the 2025 financial year. They are already working today to find out how the new information required by the directive can be determined and presented in their own company. After all, these are not figures that can be produced at the touch of a button. The challenge is that it is often necessary to draw on data that is under the control of third parties in the value chain – be they suppliers, vendors or third-party personnel. The extent of the newly required disclosures is enormous: according to estimates by auditors, the new ERSR contain more than 80 disclosure obligations, which require around 1,000 data points. Without the expansion and establishment of efficient and automated processes, it is likely to be difficult to report in the required breadth and depth in accordance with CSRD in the future.

Switzerland should not only orientate itself towards the EU, but also adopt a broad international focus

In the medium term, companies in Switzerland are also likely to be directly affected by the EU’s changes to sustainability reporting. At the end of December last year, the Federal Council announced that it would examine the extent to which the provisions currently in force in Switzerland in this regard, which are still based on the corresponding previous EU directive, should be expanded in line with the new EU requirements. For SwissHoldings, it is crucial in this regard that Switzerland does not impose any requirements on the reporting content of companies that deviate from the EU regulation. This is to avoid duplication in the reporting process. At the same time, Swiss companies should be granted flexibility in their choice of reporting standard. This is because developments in sustainability reporting are currently very dynamic worldwide. For example, the IFRS Foundation in London is currently developing a globally recognised sustainability reporting standard with the ISSB standards, which already appears to be establishing itself in numerous jurisdictions such as Japan, the United Kingdom and Australia. The corresponding rules and efforts of the US Securities and Exchange Commission (SEC) should also be mentioned in this context. Globally positioned companies such as the members of SwissHoldings should therefore also have the opportunity to fulfil their reporting in accordance with these global minimum standards.

Contact

Peter Burkhalter | Co-Head of the SwissHoldings Expert Group “Accounting and Reporting”, Head Accounting Swisscom│+41 (0)58 221 62 44

Denise Laufer | Member of the Executive Board SwissHoldings | +41 (0)31 356 68 60