This is an automatic translation, which is why errors may occur

At the heart of the new EU regulatory plans is the creation of a classification system – the so-called taxonomy – for economic activities. This is because, according to the EU Commission, investors in the financial markets need a stringent orientation system in order to be able to assess which activities are sustainable. In view of the high complexity of the new regulation, SwissHoldings recommends its members to deal with the new laws at an early stage – because the provision of the newly required key figures is likely to be a considerable challenge for companies

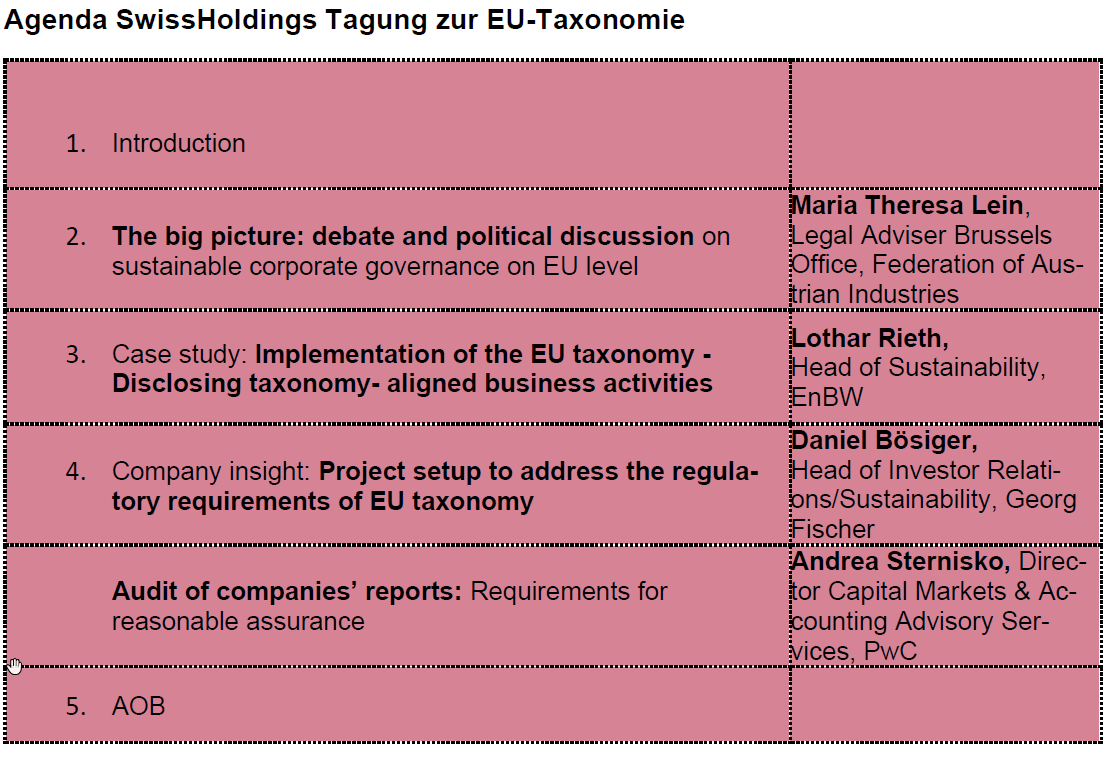

At its internal association meeting today, SwissHoldings addressed the EU’s new regulatory plans in the area of ESG and sustainable finance (see also agenda below). The media has recently widely reported on the EU Commission’s ambitious “New Green Deal” action plans, which aim to achieve climate neutrality for the EU by 2050. Less well known is that these plans will lead to a significant tightening of financial market regulation in the EU, potentially also affecting multinational companies headquartered in third countries such as Switzerland, if they have major subsidiaries in EU member states or their shares or bonds are listed on a regulated stock exchange in the EU area. With the introduction of the taxonomy, companies will in the future have to disclose separately the share of green character in terms of sales, investments (“CapEx”) as well as operating expenses (“OpEx”). In addition, all these activities must be evaluated in relation to minimum social requirement criteria.

Proper implementation of the taxonomy requires a holistic approach

According to feedback from SwissHoldings member companies, it is of key importance that the implementation of the new provisions is approached in a cross-functional manner beyond accounting, risk management and controlling. Only in this way can the identification of the relevant activities and the assessment of their taxonomy conformity be carried out in the required depth. In addition, it is essential to exchange information with peers from the same sector at an early stage. The checklists provided for the classification of economic activity are in part highly complex, and against this background it is helpful if a common understanding of the sector is developed.

The business community should closely accompany the finalization of the taxonomy

The EU has adopted the corresponding legal acts for the first two of the total of six environmental targets anchored in the taxonomy regulation. The legal acts for the other four environmental targets are to follow soon. It will be all the more important for industry to actively support this ongoing EU process. The next few years will show how practicable the taxonomy instrument will prove to be when viewed as a whole. It is essential that the business community closely monitors further developments in a constant exchange with its stakeholders and itself contributes recommendations for the revision of the taxonomy instrument to the political discussion.

Annex