Every year we publish an overview of the importance of our member companies in Switzerland and worldwide. Our publication “Facts and Figures” shows the role of the companies as employers in Switzerland and abroad, their commitment abroad in the form of direct investments and their importance on the Swiss stock exchange.

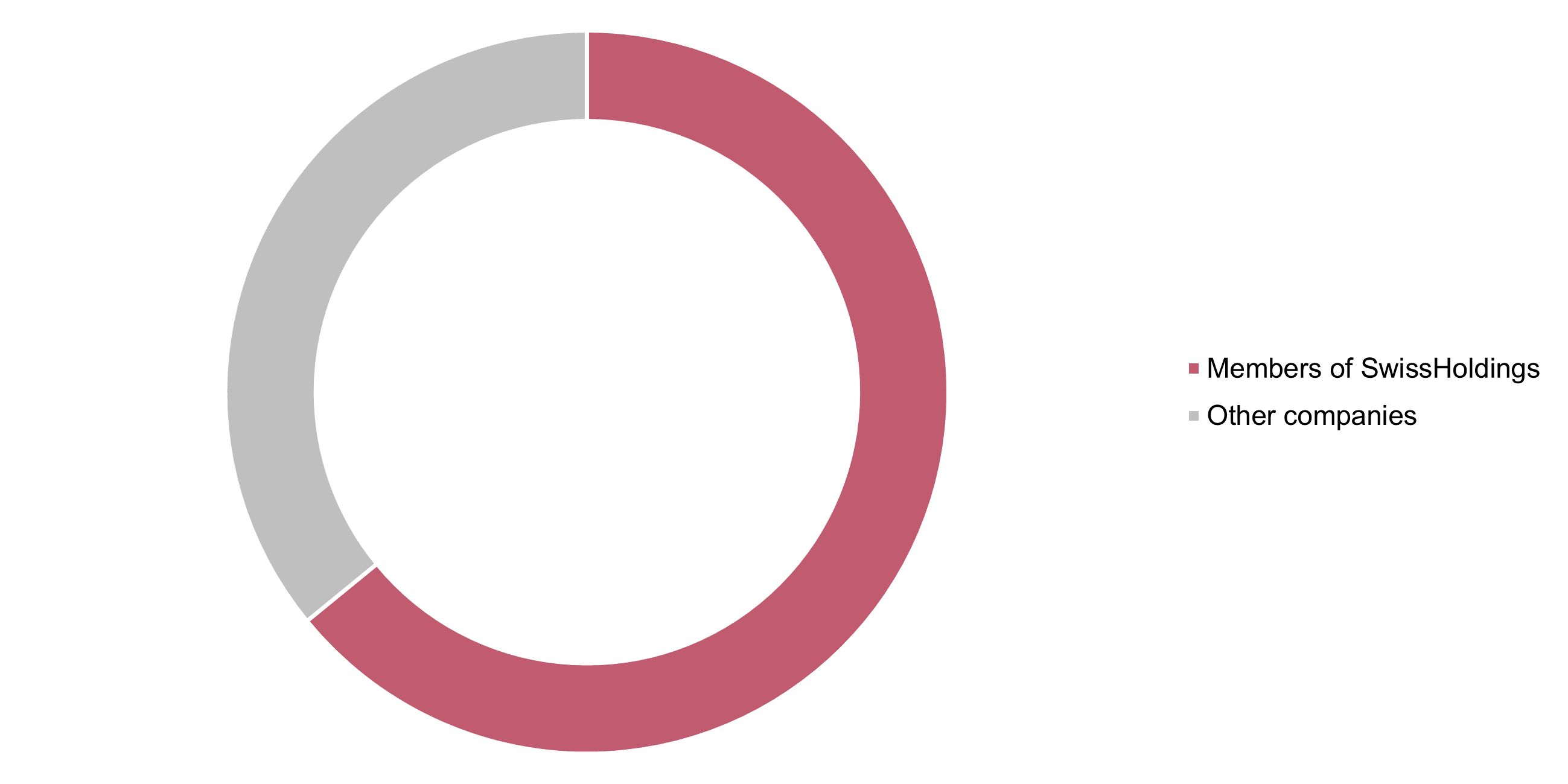

Member companies are the largest issuer group of SIX Swiss Exchange

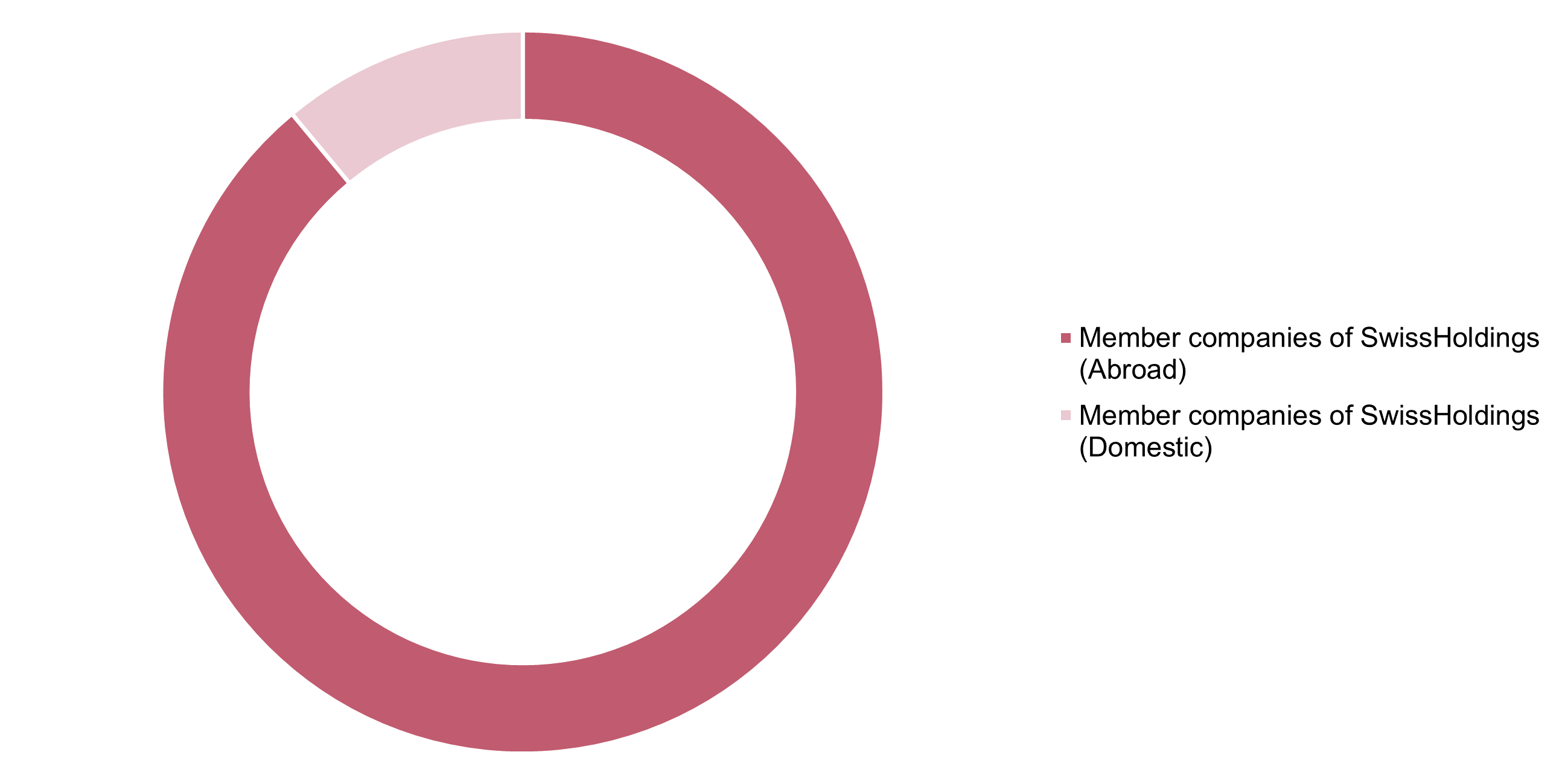

With 62 per cent, the members of SwissHoldings account for close to two thirds of the total Swiss market capitalisation on the SIX Swiss Exchange (as of 28 February 2025). Compared to the previous year, the high share was maintained. The members of SwissHoldings continue to account for the largest share of the market capitalisation on the Swiss stock exchange.

CHF 1,956 billion, 2025

Figure 1: Market capitalization of Swiss companies on the SIX Swiss Exchange

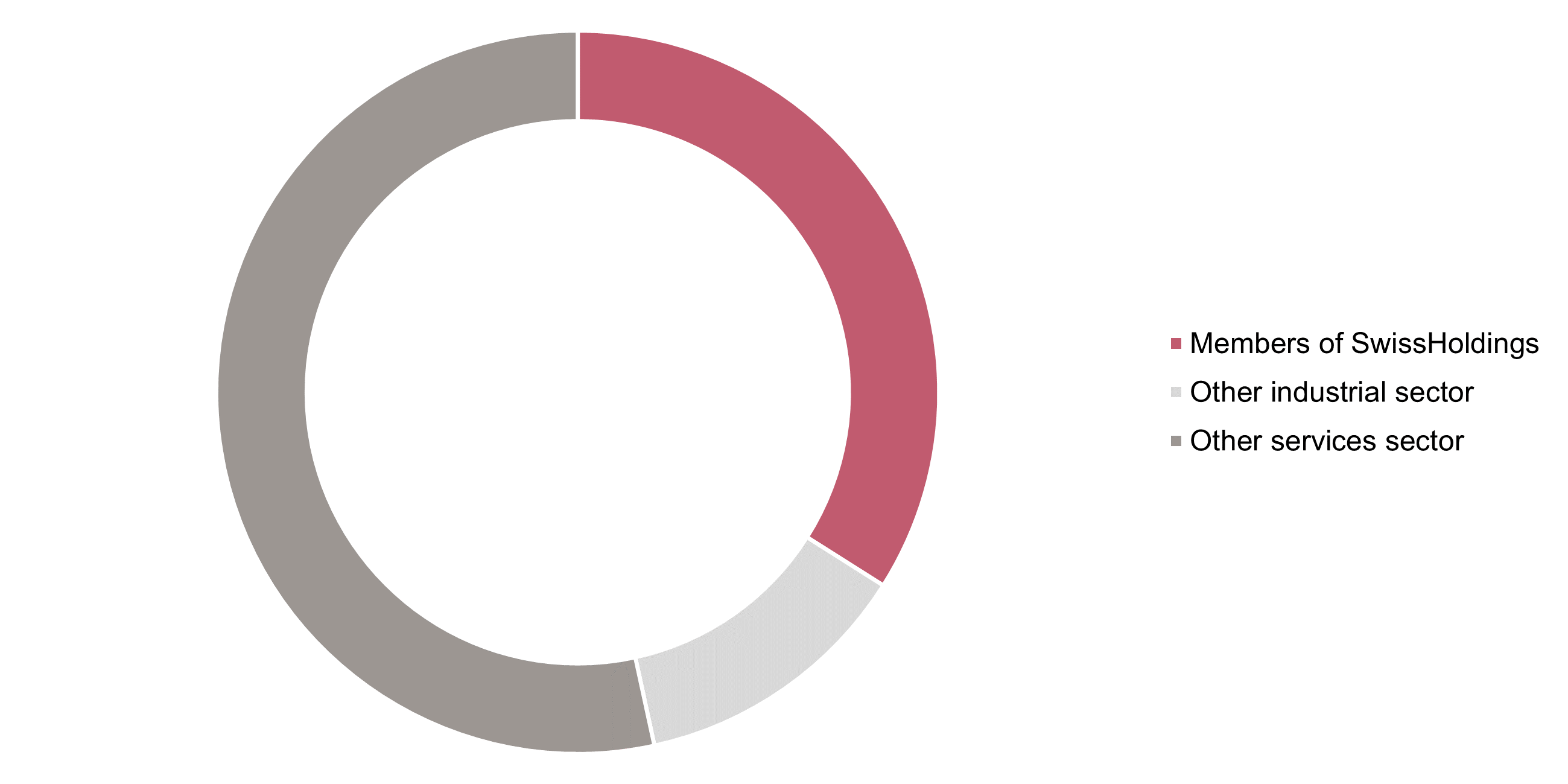

One third of the capital stock of Swiss direct investors is held by member companies, with a rising trend

In 2023, the capital stock of Swiss direct investors abroad decreased by one percent compared to the previous year, to CHF 1,288 billion. SH companies also recorded a decline in capital stock during the same period, namely by 3%. The decline is attributable to changes in the composition of the membership.

CHF 1,288 billion, 2023

Figure 2: Capital stock of total Swiss foreign direct investment

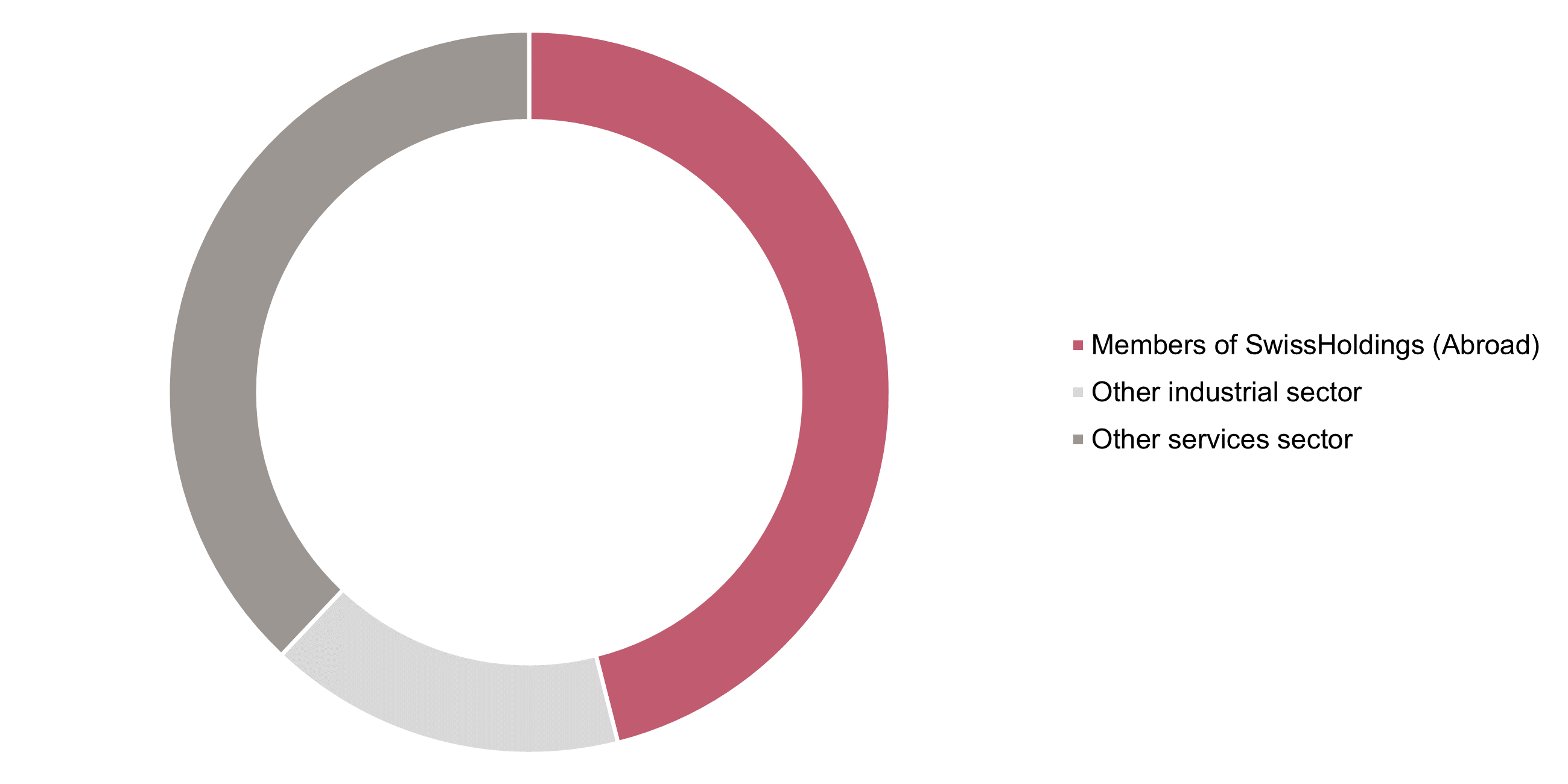

Swiss corporations currently employ close to 3.9 million people abroad

The total number of employees of Swiss direct investors abroad increased slightly in 2023 compared to the previous year. The number of employees of SwissHoldings member companies also increased, resulting in two percent growth. However, the relative share of these companies in the total workforce has declined slightly compared with the previous year.

3.9 million people, 2023

Figure 3: Workforce of total Swiss foreign direct investment

SwissHoldings member companies remain major employers

The members of SwissHoldings employed over 1.8 million people worldwide at the end of 2023. The changes compared to the previous year are only slight. The number of employees in Germany and abroad increased slightly during the year. In Germany, this results in a figure of around 200,000 employees.

1.8 million people, 2023

Figure 4: Workforce of member companies worldwide

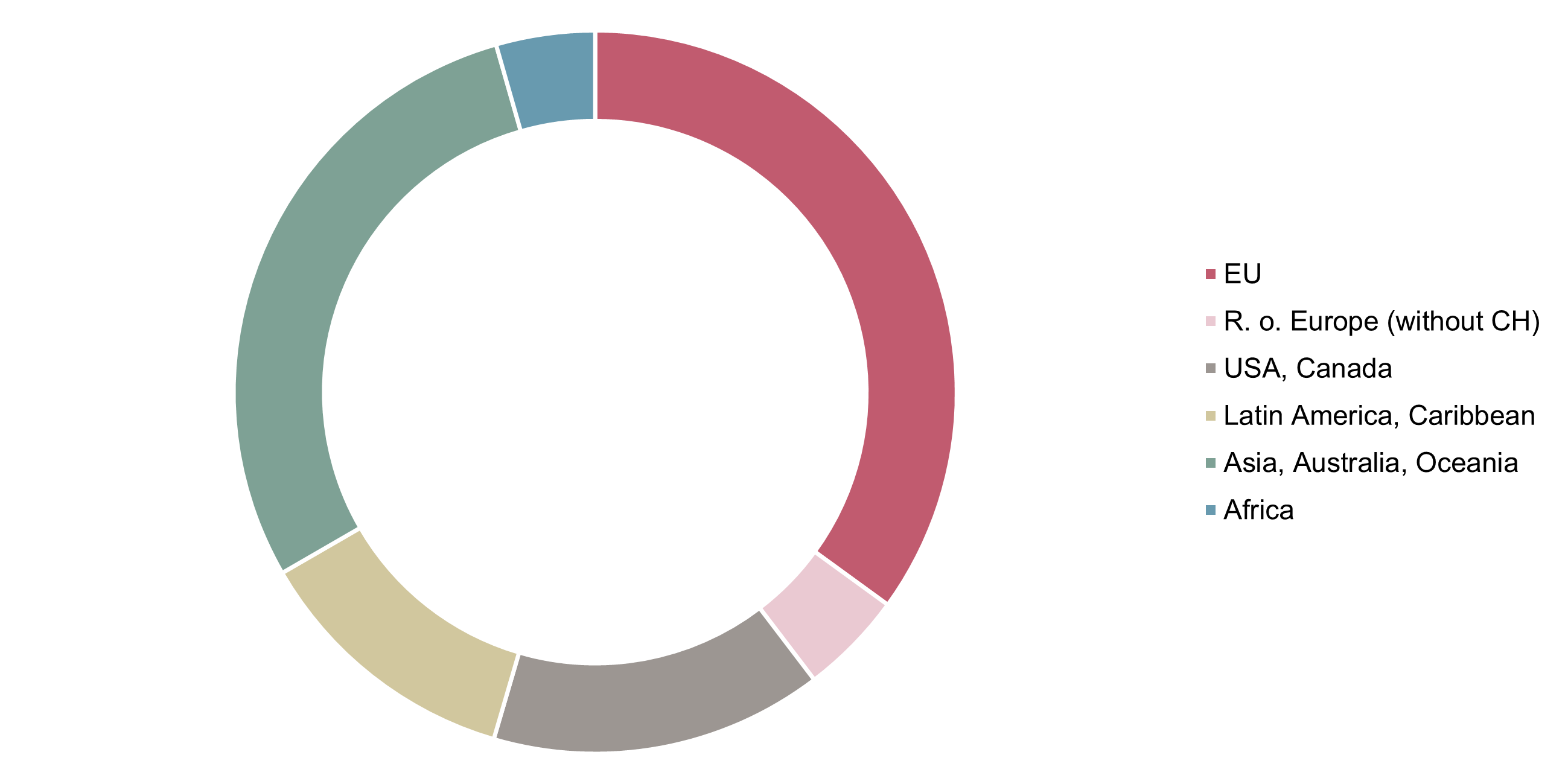

Particularly in Europe, there are changes in the workforce and capital stock

In terms of capital stock, the decline in 2023 was particularly pronounced in Latin America – especially the offshore centres there – and in the EU. In contrast, the importance of the USA, Canada, Mexico and most Mercosur countries increased significantly.

The picture for headcount is more mixed: in the EU, the number of employees rose by 3 per cent compared with the previous year. In the USA and Canada, however, it remained largely stable. Growth was also recorded in Latin America and the Caribbean (+3%) and in Australia and Oceania (+7%). By contrast, headcount declined in Asia – particularly in India, due to divestments – and in Central and Eastern Europe, where it fell by 16% as a result of the geopolitical situation in Russia.

Regional distribution of personal, 2023

Figure 5: Regional breakdown of member companies’ foreign direct investment